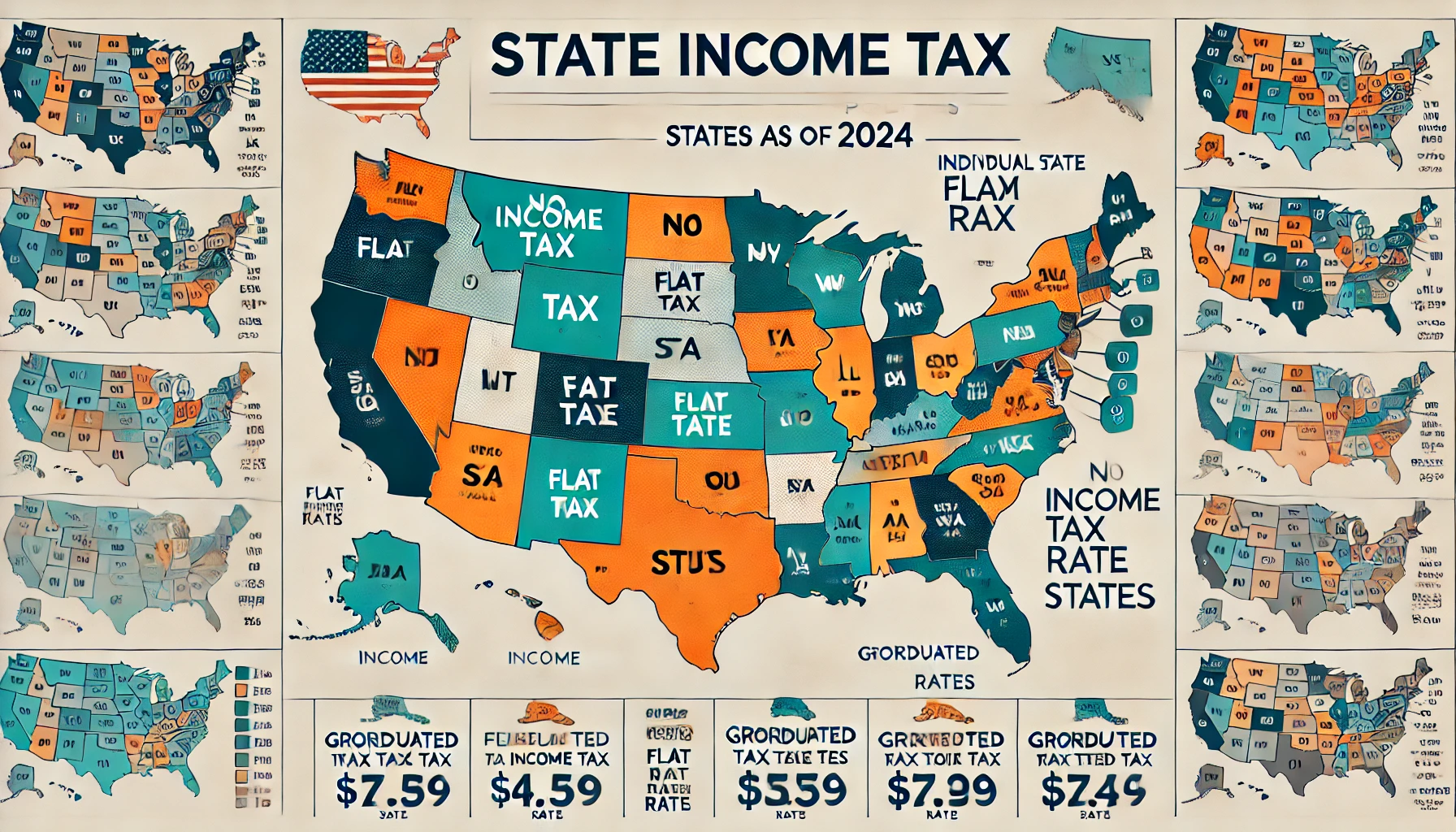

Explore the tax rates across all 50 U.S. states, including sales tax, income tax, and other state-specific taxes, with comprehensive and up-to-date information.

| States With No Income Tax | States With a Flat Income Tax | States With a Graduated-Rate Income Tax |

|---|---|---|

| Alaska (AK) | Arizona (AZ) - 2.5% | Alabama (AL) - 2% ~ 5% |

| Florida (FL) | Colorado (CO) - 4.4% | Arkansas (AR) - 2% ~ 4.9% |

| Nevada (NV) | Illinois (IL) - 4.95% | California (CA) - 1% ~ 13.3% |

| South Dakota (SD) | Indiana (IN) - 3.23% | Connecticut (CT) - 3% ~ 6.99% |

| Tennessee (TN) | Kentucky (KY) - 5% | Delaware (DE) - 2.2% ~ 6.6% |

| Texas (TX) | Massachusetts (MA) - 5% | Georgia (GA) - 1% ~ 5.75% |

| Wyoming (WY) | Michigan (MI) - 4.25% | Hawaii (HI) - 1.4% ~ 11% |

| Washington (WA (wage income only)) | New Hampshire (NH) - 5% (interest/dividend only) | Idaho (ID) - 1% ~ 6% |

| North Carolina (NC) - 4.75% | Iowa (IA) - 0.33% ~ 8.53% | |

| Pennsylvania (PA) - 3.07% | Kansas (KS) - 3.1% ~ 5.7% | |

| Utah (UT) - 4.85% | Louisiana (LA) - 2% ~ 6% | |

| Maine (ME) - 5.8% ~ 7.15% | ||

| Maryland (MD) - 2% ~ 5.75% | ||

| Minnesota (MN) - 5.35% ~ 9.85% | ||

| Mississippi (MS) - 4% ~ 5% | ||

| Missouri (MO) - 1.5% ~ 4.95% | ||

| Montana (MT) - 1% ~ 6.75% | ||

| Nebraska (NE) - 2.46% ~ 6.64% | ||

| New Jersey (NJ) - 1.4% ~ 10.75% | ||

| New Mexico (NM) - 1.7% ~ 5.9% | ||

| New York (NY) - 4% ~ 10.9% | ||

| North Dakota (ND) - 1.1% ~ 2.9% | ||

| Ohio (OH) - 2.765% ~ 3.99% | ||

| Oklahoma (OK) - 0.25% ~ 4.75% | ||

| Oregon (OR) - 4.75% ~ 9.9% | ||

| Rhode Island (RI) - 3.75% ~ 5.99% | ||

| South Carolina (SC) - 0% ~ 7% | ||

| Vermont (VT) - 3.35% ~ 8.75% | ||

| Virginia (VA) - 2% ~ 5.75% | ||

| West Virginia (WV) - 3% ~ 6.5% | ||

| Wisconsin (WI) - 3.54% ~ 7.65% |