The world of fraud is shifting rapidly. As the number and complexity of digital transactions increase, so do the methods fraudsters use to exploit flaws in digital environments. Unlike many traditional machine learning models that rely solely on pre-existing data on historical behavior, ggenerative AI can generate predictions and learn to adapt to evolving fraud patterns. In this article, we discuss how generative AI enhances fraud detection systems and where it delivers the most outstanding value to organizations.

Understanding Fraud Detection Challenges

Systems must block fraudulent activity while also making it easy for legitimate customers to access the system when conducting business. Investigations into fraud or risk are constantly faced with several repetitive challenges:

- Rapidly changing patterns of fraud that exceed the rules that are often stagnant

- High rates of false positives that result in customer frustration

- Limited adaptability to new attack vectors

Although machine learning has improved detection accuracy, even advanced models have a high failure rate when fraudsters change their behavior to evade pattern-based detection.

What Is Generative AI and Why It Matters

Generative AI refers to models' ability to generate new information, actions, or environments using prior knowledge about the nature of those inputs. There are several traditional generative AI techniques used to detect fraud using generative AI models, including:

- Generative Adversarial Networks (GANs)

- Variational Autoencoders (VAEs)

- Generative models based on transformer architectures

- Large Language Model (LLM) methods for generating language-based behavioral or text analyses

The primary benefit of a network with generative models is its ability to anticipate what has not yet been experienced, rather than simply reacting to what has.

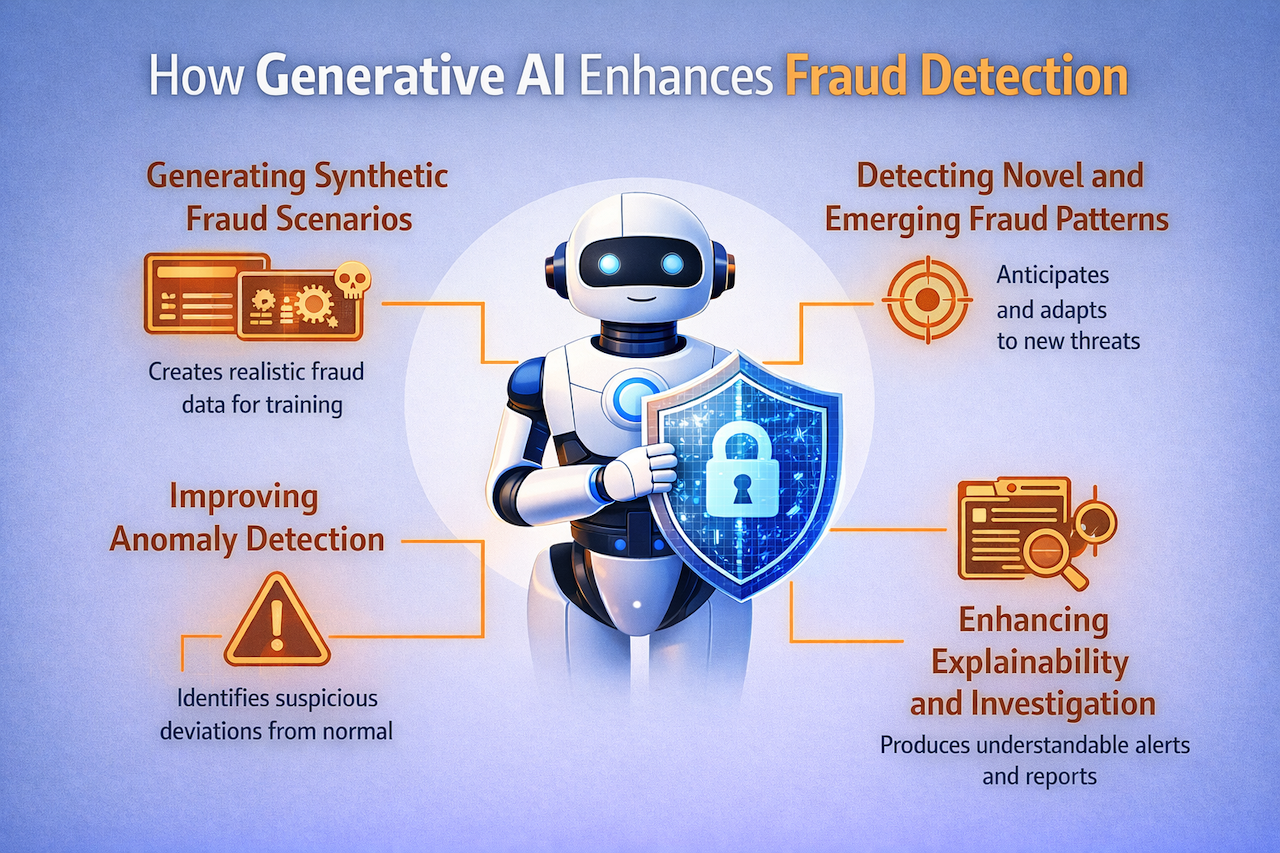

Using Generative AI for Fraud Detection

Generative AI reshapes fraud detection by moving beyond historical patterns and static rules, enabling systems to anticipate new threats and adapt to evolving techniques through ongoing generative AI development.

Synthetic Fraud Scenario Generators

When it comes to identifying fraudulent behavior, there is a fundamental lack of high-quality fraud data for this process. Fraud is generally infrequent, highly confidential, and fast-moving. Generative AI can:

- Create highly realistic examples of synthetic fraud

- Balance out datasets that have been skewed

- Expose the models to edge cases that some would call “rare,” but which are actually highly critical

- Enhance the robustness of the model during training stages

In turn, this enables the detection model to be substantially better prepared for the types of threats we may encounter in practice.

Detecting Emerging and New Patterns of Fraud

Typical models have been trained to recognize the patterns that have been registered in the past. Generative AI, however, can simulate the likelihood of fraud arising from previously established behaviors of those committing it. Generative systems can:

- Identify anomalies in the data that do not conform to what has historically been recorded

- Detect fraudulent techniques that have not, to date, ever been recorded as being perpetrated

- Adapt more quickly to emerging threats

This capability is helpful in environments where fraud methods evolve rapidly, such as digital payments and online marketplaces.

Developing More Effective Anomaly Detection

Generative models can develop a detailed understanding of "normal" behaviors. When a real-world occurrence deviates from the generative model's expectations of normality, it can alert users to the potential for deception. The use of generative models will:

- Reduce reliance on "hard-coded" rules

- Improve the detection of abnormal behavior or anomalies

- Reduce false positive rates

- Enable continuous adaptation and improvement

Generative AI will ask the question "Does this behavior make any sense at all?" when assessing potential fraud, rather than "Does this fall within an existing or known pattern of fraud?"

Improving Explainability and Investigation

By utilizing interpretable, model-based approaches and language models, fraud analysts can:

- Generate descriptions of alerts that are easy for humans to understand

- Summarize behavior patterns associated with suspected fraud

- Suggest additional investigative steps that can be taken

- Improve the speed at which an investigation may be completed

- Reduce the overall workload of the analyst conducting an investigation

The anticipated outcome is that the use of generative AI will enable more efficient and effective investigations and reporting on compliance matters.

Considerations for Implementation and Risk

Even though generative AI offers many advantages when used correctly for fraud detection, it can also have drawbacks. Here are some key considerations:

Data Quality and Data Governance

- Synthetic data needs to demonstrate reasonable behaviors

- Unbiased training data is necessary

- Strict controls must ensure that no data is abstracted into a new training set

Model Transparency and Compliance

- Regulatory environments demand explainability

- Decisions must be auditable

- Human oversight remains essential

Adversarial Risk

- Fraudulent individuals may try to manipulate your models

- Implement security measures to protect yourself against exploitation

- Ongoing vigilance will help you prevent or mitigate adverse effects

Infrastructure and Costs

- Generative models require significant computational resources

- Implementing generative models will require scalable computer systems

- It is critical to know how you will achieve return on investment before initiating an implementation project

The Future of Generative AI in Fraud Prevention

The ability of generative AI to transform and enhance fraud detection has shifted reactive processes onto proactive, predictive capabilities. In the future, we can anticipate:

- Fraud prevention systems that utilize real-time adaptive technology

- Multi-agent AI models that simulate the attacker-defender dynamic

- Closer integration with identity verification solutions

- Increased collaboration between AI and human analysts

- More stringent regulations around decisions made using AI

A company that adopts generative AI is well-positioned to respond to current and future fraud threats.

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment