Fintech applications have become a core part of modern financial systems. Mobile banking, digital payments, lending platforms, and investment apps now shape how individuals and businesses manage money. As financial products increasingly move to online platforms, organizations must design and build fintech applications that are secure, reliable, and scalable.

Fintech app development requires strong software engineering capabilities, along with careful consideration of regulatory requirements, data protection, system integration, and long-term maintainability. Depending on internal resources and project scope, these needs may be addressed through in-house teams or fintech software development services. Key development processes and architectural decisions are established early in the planning phase, influencing performance, compliance, and future growth.

This article explains how to create a fintech app step by step. It outlines the main types of fintech applications, the key technical and regulatory requirements, and the essential development stages teams typically follow when bringing financial products to market.

What Is a FinTech App?

A fintech app is a digital product that delivers financial functionality through web or mobile platforms. These applications may support payment processing, money transfers, lending, investing, budgeting, or financial analysis.

Unlike many consumer applications, fintech products handle highly sensitive personal and financial data. As a result, security, compliance, and auditability must be built into the system from the beginning, particularly because these applications operate in regulated environments.

Types of FinTech Apps

Identifying the type of fintech app you plan to build is an important first step, as it affects scope, functionality, and compliance requirements.

Digital Banking Apps

Digital banking applications provide users with access to core banking functions such as account management, payments, fund transfers, and customer support. These apps often integrate with core banking systems and external financial APIs.

Payment and Wallet Apps

Payment applications allow users to send and receive money, make online purchases, and complete in-store transactions. These platforms must process transactions quickly while maintaining high availability and strong protections against fraud.

Lending and Credit Apps

Lending applications manage workflows related to loan applications, credit assessments, repayment schedules, and user onboarding. Transparency in decision-making and adherence to lending regulations are essential components of these systems.

Investment and Trading Apps

Investment applications enable users to trade assets, manage portfolios, and access market data. Accuracy, performance, and reliability are critical, as these products often operate under strict regulatory and reporting requirements.

Personal Finance and Budgeting Apps

Personal finance apps help users track expenses, set savings goals, and analyze spending habits. While these applications may face less regulatory oversight than banking platforms, they still require strong security due to the sensitive nature of the data involved.

Core Requirements for FinTech App Development

Despite differences between product types, most fintech applications share several foundational requirements.

Regulatory Compliance

Fintech applications must comply with applicable financial regulations, which vary by region and product type. Compliance requirements influence system architecture, data storage practices, and operational processes throughout the application lifecycle.

Security and Data Protection

Security is a fundamental requirement in fintech development. Common practices include:

- Encrypting data at rest and in transit

- Implementing secure authentication and authorization mechanisms

- Using role-based access controls to manage permissions

- Monitoring systems continuously and performing regular security assessments

Strong security measures help protect users and support compliance with regulatory standards.

Scalability and Performance

Many fintech platforms experience rapid user and transaction growth. System architectures must be designed to:

- Process high volumes of transactions

- Support real-time data handling

- Scale individual components independently

Designing for scalability early helps avoid costly system redesigns as usage increases.

Integration Capabilities

Fintech applications often rely on integrations with external systems, such as:

- Banking and open banking APIs

- Payment gateways

- Identity verification platforms

- Analytics and reporting tools

Reliable integration management is essential to ensure consistent system operation.

Key Features of a FinTech App

While specific features vary by product type, many fintech applications include:

- User registration and authentication

- Identity verification

- Transaction history and management

- Notifications and alerts

- Administrative dashboards and reporting tools

Feature prioritization is typically guided by product goals and regulatory requirements.

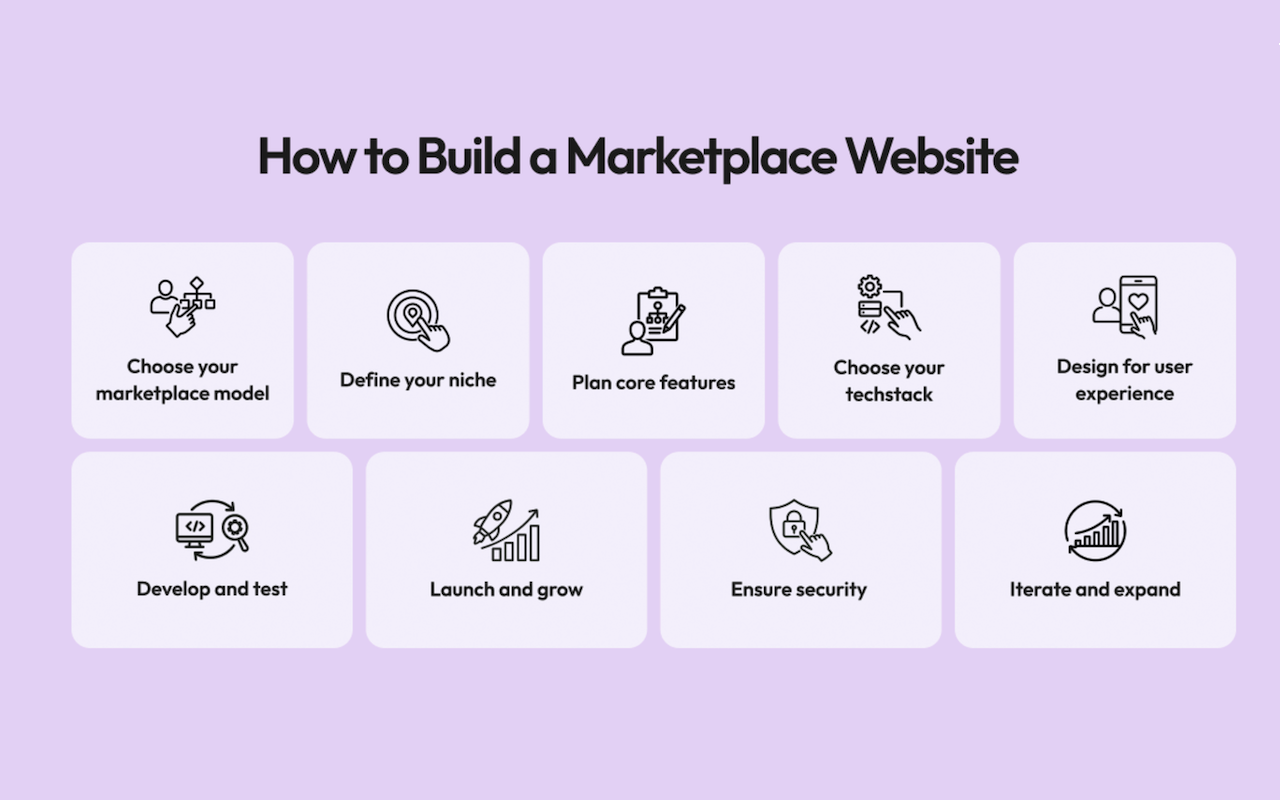

FinTech App Development Stages

Fintech app development generally follows a structured, multi-stage process.

1. Discovery and Planning

This stage defines the product vision, target users, and regulatory landscape. Teams conduct research, assess technical feasibility, and identify potential risks while outlining an initial system architecture.

2. Product Design

Product design covers both user experience and system architecture. Designers create user flows and interfaces, while architects define backend structures and data flows. Clear documentation helps align teams and reduce development risks.

3. Development and Integration

During development, teams build frontend and backend components, implement security controls, and integrate required external systems. Collaboration between developers, testers, and compliance stakeholders is essential at this stage.

4. Testing and Quality Assurance

Testing in fintech projects extends beyond functional checks and typically includes security testing, performance and load testing, compliance validation, and integration testing. Thorough testing reduces the risk of costly issues after launch.

5. Deployment and Launch

Deployment involves setting up infrastructure, configuring monitoring, and validating system readiness. Many teams use staged or limited releases to manage risk during early user adoption.

6. Maintenance and Continuous Improvement

After launch, fintech applications require ongoing updates, including security patches, compliance adjustments, feature enhancements, and performance optimizations. Continuous improvement supports long-term stability and adaptability.

Common Challenges When Creating a FinTech App

Regulatory Complexity

Frequent regulatory changes and regional differences add complexity to fintech development. Teams must monitor legal updates and ensure systems remain compliant over time.

Data Sensitivity

Handling financial data demands strict governance and security controls. Failures in data protection can lead to legal penalties and reputational harm.

Integration Risks

Dependence on third-party systems can introduce reliability and performance risks. Monitoring, redundancy, and fallback mechanisms help reduce service disruptions.

How Long Does It Take to Build a FinTech App?

Development timelines vary based on product scope and technical complexity. A minimum viable product may take three to five months, while mid-scale platforms often require six to nine months. Larger enterprise solutions can take nine to fifteen months or longer. Discovery and compliance preparation frequently account for the longest delays.

Final Thoughts

Building a fintech app requires careful coordination between technical design, security, compliance, and user experience. By understanding application types, core requirements, and development stages, teams can make informed decisions and reduce risk when launching products in competitive financial markets.

Featured Image generated by Google Gemini.

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment