Electronic Health Records (EHRs) were introduced to digitize patient data and improve care coordination. Traditional EHR systems face difficulties because they receive excessive data that requires ...

Read MoreScanning... This may take a couple of minutes!

On-Page SEO Result:

Rankings and Links

Speed Insights

SeoMetrics

Accessibility

BestPractices

Performance

Artificial intelligence is no longer limited to big tech companies. Today, AI is influencing industries that once relied heavily on human instinct, and professional sports are a prime example. Fro ...

Read MoreThe world of fraud is shifting rapidly. As the number and complexity of digital transactions increase, so do the methods fraudsters use to exploit flaws in digital environments. Unlike many traditiona ...

Read MoreWebsite traffic is a primary metric for measuring success in modern digital environments. The business world believes that higher visitor numbers will lead to greater visibility, higher conversion ...

Read MoreStarting a business is exciting, but marketing it effectively with a limited budget can be challenging. Many startups want to grow quickly without the ability to invest heavily in advertising. For ...

Read MorePDF files have become the standard for sharing professional documents, whether for contracts, reports, or marketing materials. They preserve formatting across devices and maintain a polished, prof ...

Read MoreAs online competition increases, retaining user attention has become just as crucial as attracting it. AI-powered marketing helps businesses understand visitor behavior and deliver better experien ...

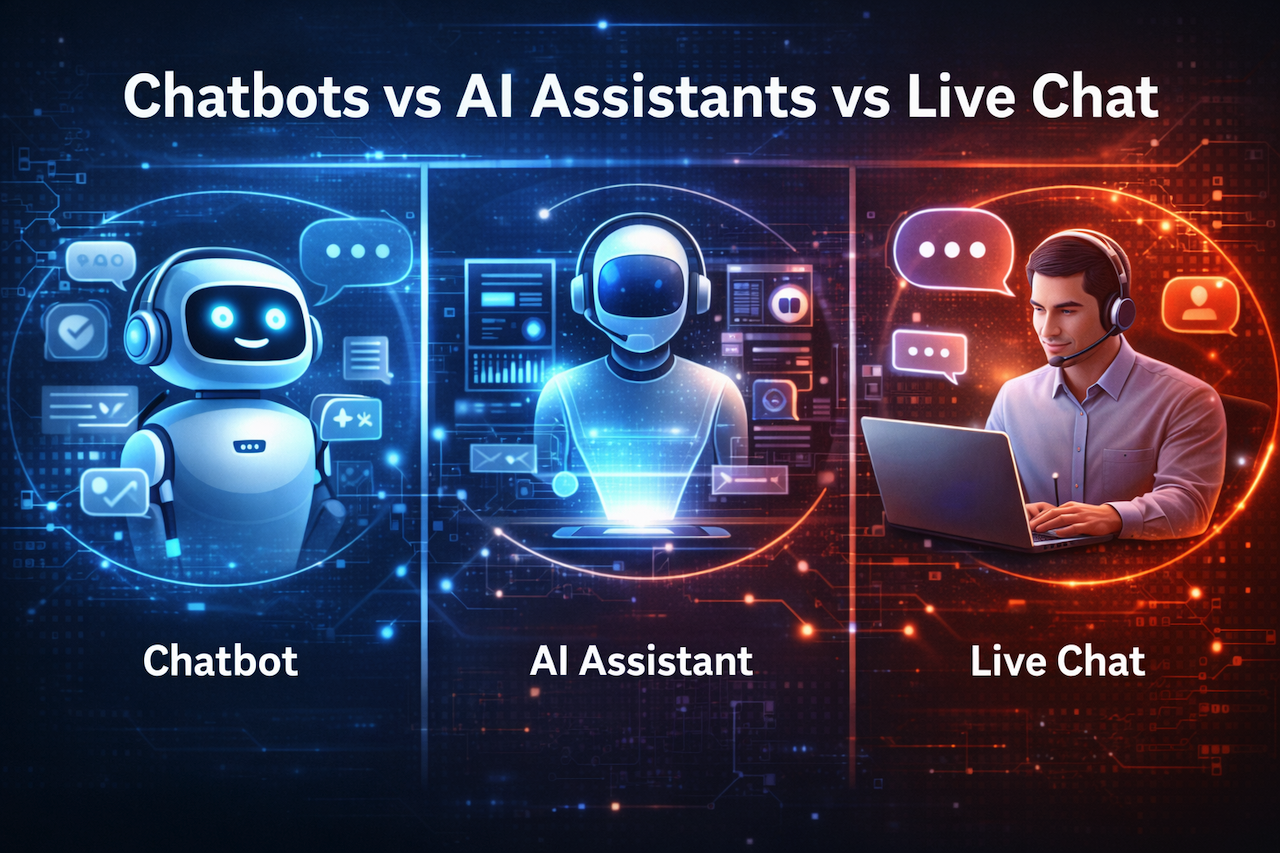

Read MoreModern users communicate with brands through AI tools, which have become a common trend. As a result of this shift, customer communication has evolved from a ticket-based, wait-heavy process to fa ...

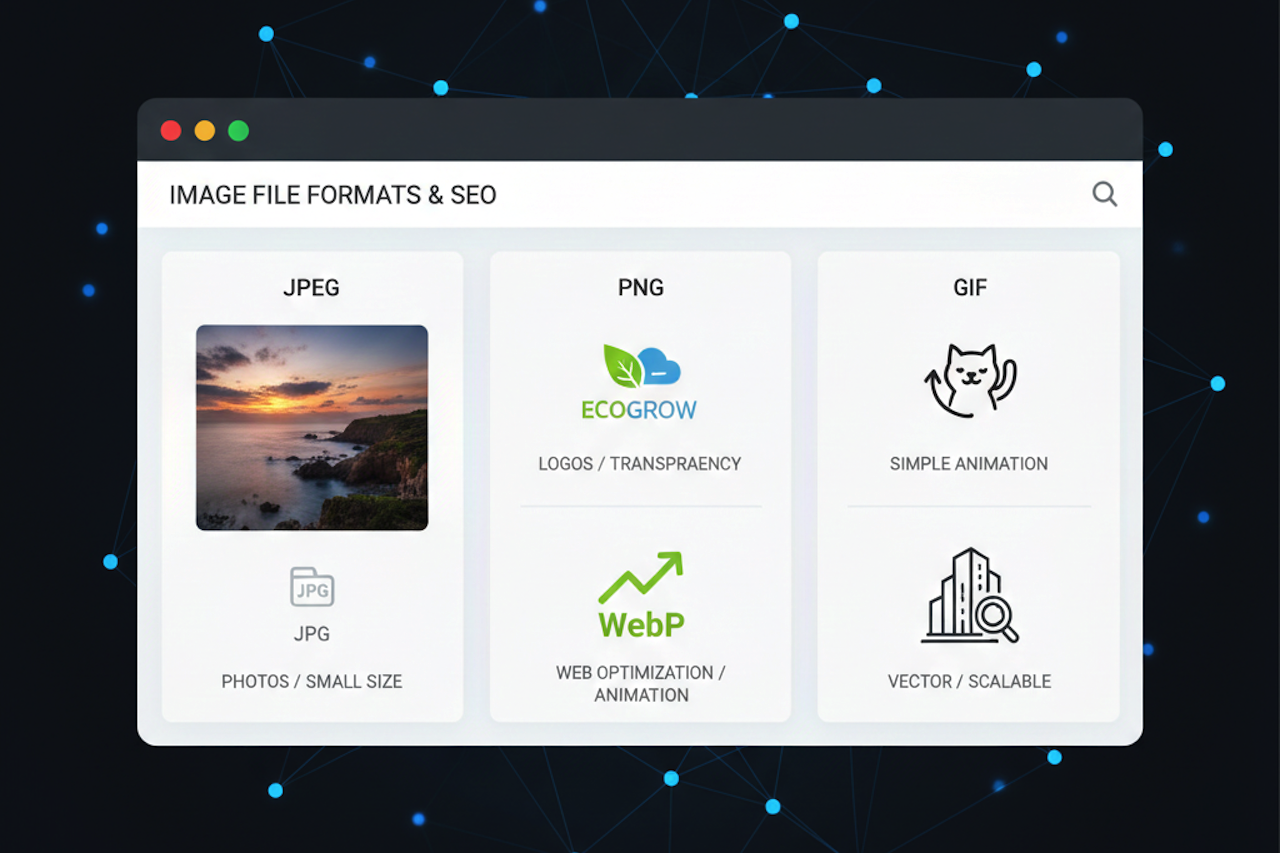

Read MoreChoosing the correct image file format is a crucial yet often overlooked part of digital content creation. Whether you are designing a website, publishing a blog, managing an e-commerce store, or ...

Read MoreContemporary laboratories operate in an arena where speed, accuracy, and reliability directly translate into outcomes, credibility, and cost. Whether in research, manufacturing, or testing, labora ...

Read MoreTraffic exchange platforms are often misunderstood. Many marketers focus on the volume they deliver while overlooking the real opportunity they present: turning short visits into long-term audienc ...

Read MoreFintech applications have become a core part of modern financial systems. Mobile banking, digital payments, lending platforms, and investment apps now shape how individuals and businesses manage m ...

Read MoreYou don’t need a big budget or masterful technical skills to build a strong brand and show up online. There are lots of easy tools to help small businesses, freelancers, and even passion project ...

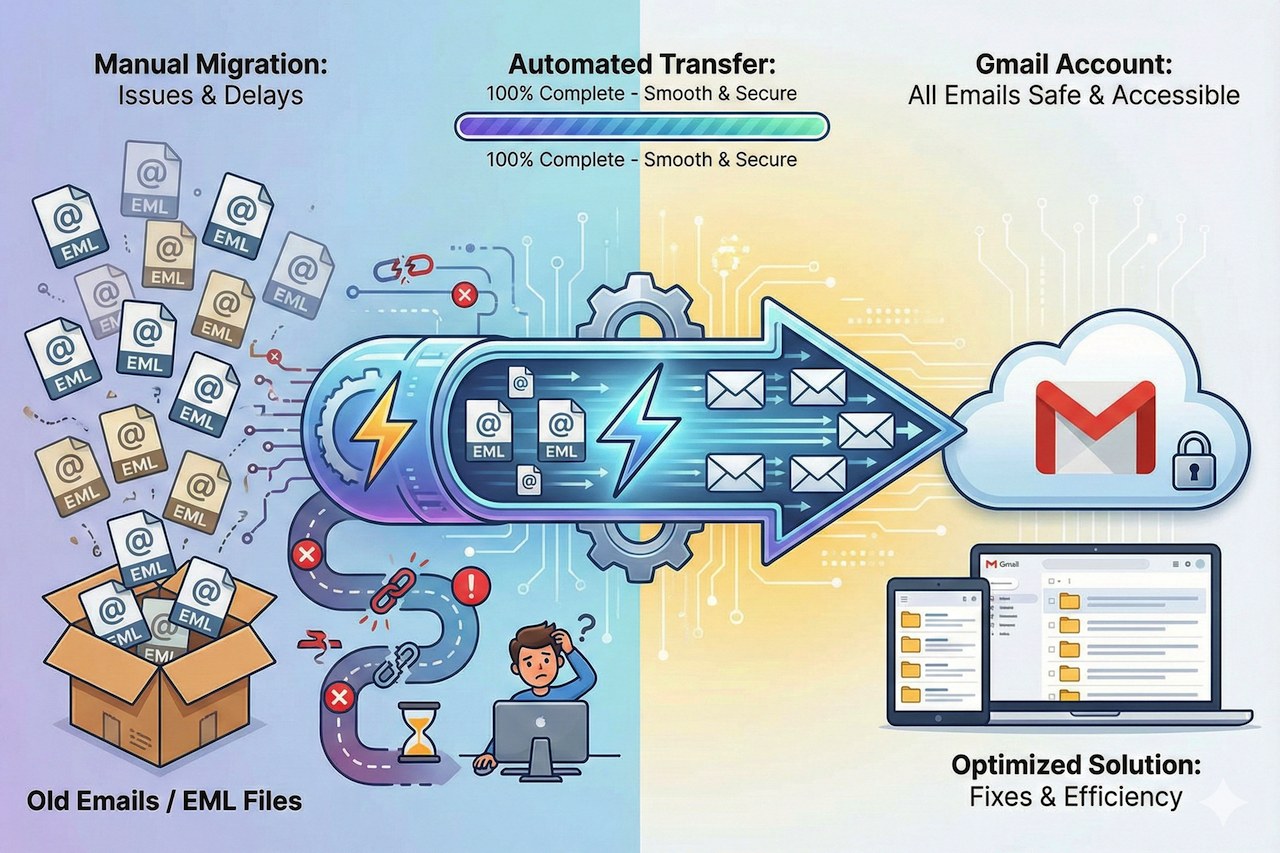

Read MoreMany users need to move EML files to Gmail these days. Many people want to keep all their old emails in one safe place. Gmail is easy to use and quite secure. But moving things around can cause co ...

Read MorePeople do not think about apps the way they once did. They no longer want an app for exploring. They open them because they need something done. Quickly. Quietly. Without resistance. That expectat ...

Read MoreIn today’s fast-paced digital world, organizations need to deliver high-quality applications faster than ever before. User needs shift constantly, technologies evolve quickly, and competition is ...

Read More